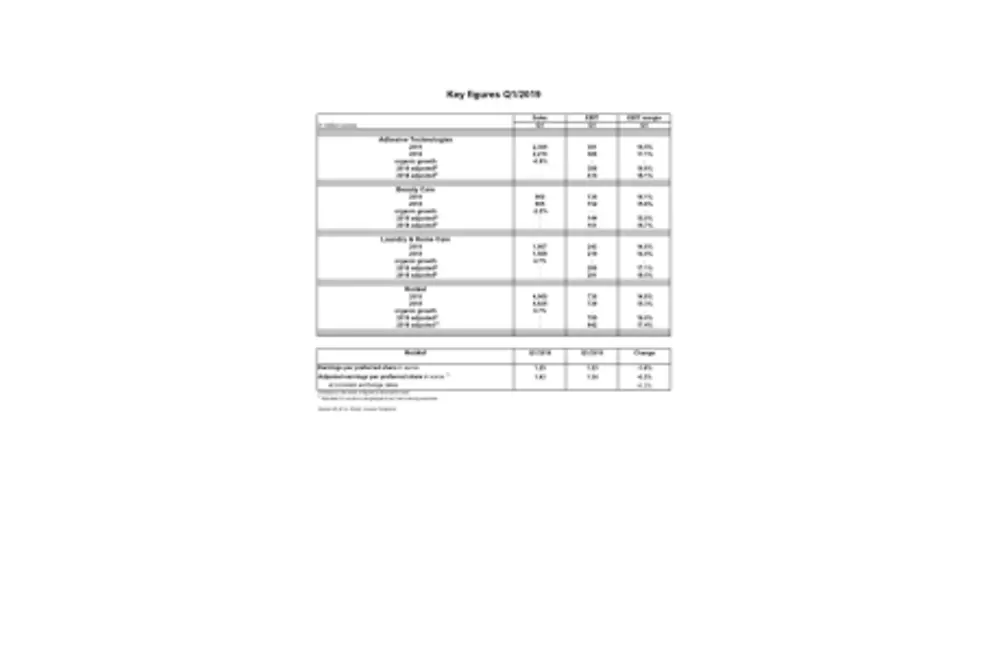

- Sales rise by 2.8% to 4,969 million euros, organic growth +0.7%

- Operating profit (EBIT)* amounts to 795 million euros (-5.6%)

- EBIT margin* at 16.0% (-140 basis points)

- Earnings per preferred share* reach 1.34 euros, -6.3% at constant currencies

- Strong free cash flow development: 523 million euros

- Investing in growth and increasing competitiveness

“Despite an increasingly challenging market environment Henkel delivered positive sales growth in the first quarter, both organically and in nominal terms. On Group level, adjusted EBIT margin and adjusted EPS development were within the range of our outlook for the full fiscal year,” said Henkel CEO Hans Van Bylen.

“Overall, our business development in the first quarter 2019 was mixed. As expected, our Adhesive Technologies business was impacted by the deceleration of industrial production in several industries, with improvements expected in the course of the second half of this year,” Hans Van Bylen explained.

“In our consumer goods businesses, the performance of Beauty Care was below our expectations. While we successfully launched new brands and innovations and our hair professional business continued to outperform markets, we faced negative developments of our retail business in key regions such as Western Europe and China. We are addressing this development with targeted measures, aiming to boost growth and improve the performance of our Beauty Care business,” Hans Van Bylen added.

“On the other hand, our Laundry & Home Care business had a good start to the year, also supported by the launch of innovations and new products.”

Investing in growth and improving competitiveness

“Going forward, we will focus on further strengthening our business, invest in growth and digitalization and continue to adapt our structures in order to achieve our targets for the full year,” Hans Van Bylen said.

At the beginning of the year, Henkel announced to step up growth investments aiming to capture additional growth opportunities, mainly in its consumer goods businesses, and to further accelerate the digital transformation. Henkel is also implementing a range of measures to further increase the competitiveness of its businesses.

Outlook 2019 confirmed

“We confirm the outlook for the full fiscal year,” said Hans Van Bylen. “We expect an organic sales growth of between 2 and 4 percent in the current fiscal year. For the adjusted EBIT margin, we expect a range of 16 to 17 percent and an adjusted EPS in the mid-single percentage range below prior year at constant exchange rates.”

Sales and earnings performance in the first quarter 2019

Sales in the first quarter 2019 rose nominally by 2.8 percent to 4,969 million euros. Organic sales, which exclude the impact of currency effects and acquisitions/divestments, showed an increase of 0.7 percent. The contribution from acquisitions and divestments amounted to 0.6 percent. Currency effects had a positive impact of 1.5 percent on sales.

In the Adhesive Technologies business unit, sales decreased organically by 0.8 percent, mainly due to a deceleration in the electronics and automotive sectors. Sales of the Beauty Care business unit were organically 2.2 percent below the prior-year quarter, mainly due to a weak performance of the retail business in Western Europe and in China. The Laundry & Home Care business unit posted a very strong organic sales growth of 4.7 percent, supported by the positive contributions from the successful launch of new products and innovations in key markets.

The emerging markets again made an above-average contribution to the organic growth of the Group, with a good organic sales growth of 2.2 percent. The mature markets registered a negative organic sales development of -0.4 percent.

Sales in Western Europe declined organically by 1.3 percent. Eastern Europe achieved organic growth of 6.5 percent. In Africa/Middle East, sales grew organically by 13.5 percent. Sales in the North America region increased organically by 1.1 percent. Latin America achieved organic growth of 8.0 percent, and in the Asia-Pacific region, sales were 8.8 percent below the level of the prior-year quarter.

Adjusted operating profit (EBIT) reached 795 million euros, 5.6 percent below the level of the first quarter 2018 (842 million euros).

Adjusted return on sales (EBIT) was 16.0 percent, 1.4 percentage points below the prior-year level.

Adjusted earnings per preferred share decreased by 6.3 percent from 1.43 euros in the first quarter of 2018 to 1.34 euros in the first quarter 2019. At constant exchange rates, EPS development likewise was -6.3 percent.

With 6.6 percent, net working capital as a percentage of sales was above the level of the first quarter 2018 (6.2 percent).

At 523 million euros, free cash flow in the first quarter of 2019 was substantially higher than in the same period of the previous year (22 million euros). This development is evidence of the company’s special ability to generate free cash flow.

Effective March 31, 2019, Henkel’s net financial position showed a balance of -2,478 million euros (December 31, 2018: -2,895 million euros).

Business unit performance

The Adhesive Technologies business unit generated a slightly negative organic sales development of -0.8 percent in the first quarter. Nominally, sales increased by 1.7 percent to 2,309 million euros. Adjusted operating profit reached 388 million euros after 410 million euros in the prior-year quarter. Adjusted return on sales was 16.8 percent (first quarter 2018: 18.1 percent).

Sales of the Beauty Care business unit decreased organically by 2.2 percent in the first quarter. In nominal terms, sales amounted to 960 million euros after 965 million euros in the prior-year quarter. Adjusted operating profit of 144 million euros and adjusted return on sales of 15.0 percent were lower than in the same quarter of the previous year.

The Laundry & Home Care business unit registered organic sales growth of 4.7 percent in the first quarter. Nominally, sales grew by 6.3 percent and reached 1,667 million euros. At 286 million euros, adjusted operating profit was 1.9 percent below the level of the first quarter 2018. Adjusted return on sales reached

17.1 percent and was below the level of the prior-year quarter.

* Adjusted for one-time charges/gains and restructuring charges.

This information contains forward-looking statements which are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. Statements with respect to the future are characterized by the use of words such as “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, and similar terms. Such statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update any forward-looking statements.

This document includes – in the applicable financial reporting framework not clearly defined – supplemental financial measures that are or may be alternative performance measures (non-GAAP-measures). These supplemental financial measures should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial positions or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.